5% within the day, 10% total retracement: What core test points are hidden in EagleTrader risk control rules

- 2025年9月9日

- Posted by: Eagletrader

- Category: News

Many traders often hold the idea when taking the EagleTrader exam: as long as they grasp the market and make quick and much money, they will definitely pass the test smoothly. But when I really went on stage, I realized that the difficulty of the exam was not “make money or not”, but whether I could keep the bottom line between profit and loss.

When this “bottom line” is embodied as a risk control standard, the restrictions on intraday retracement and total retracement are like an invisible red line, making many traders feel that “hands and feet are bound.” So, why should such standards be set for the exam?

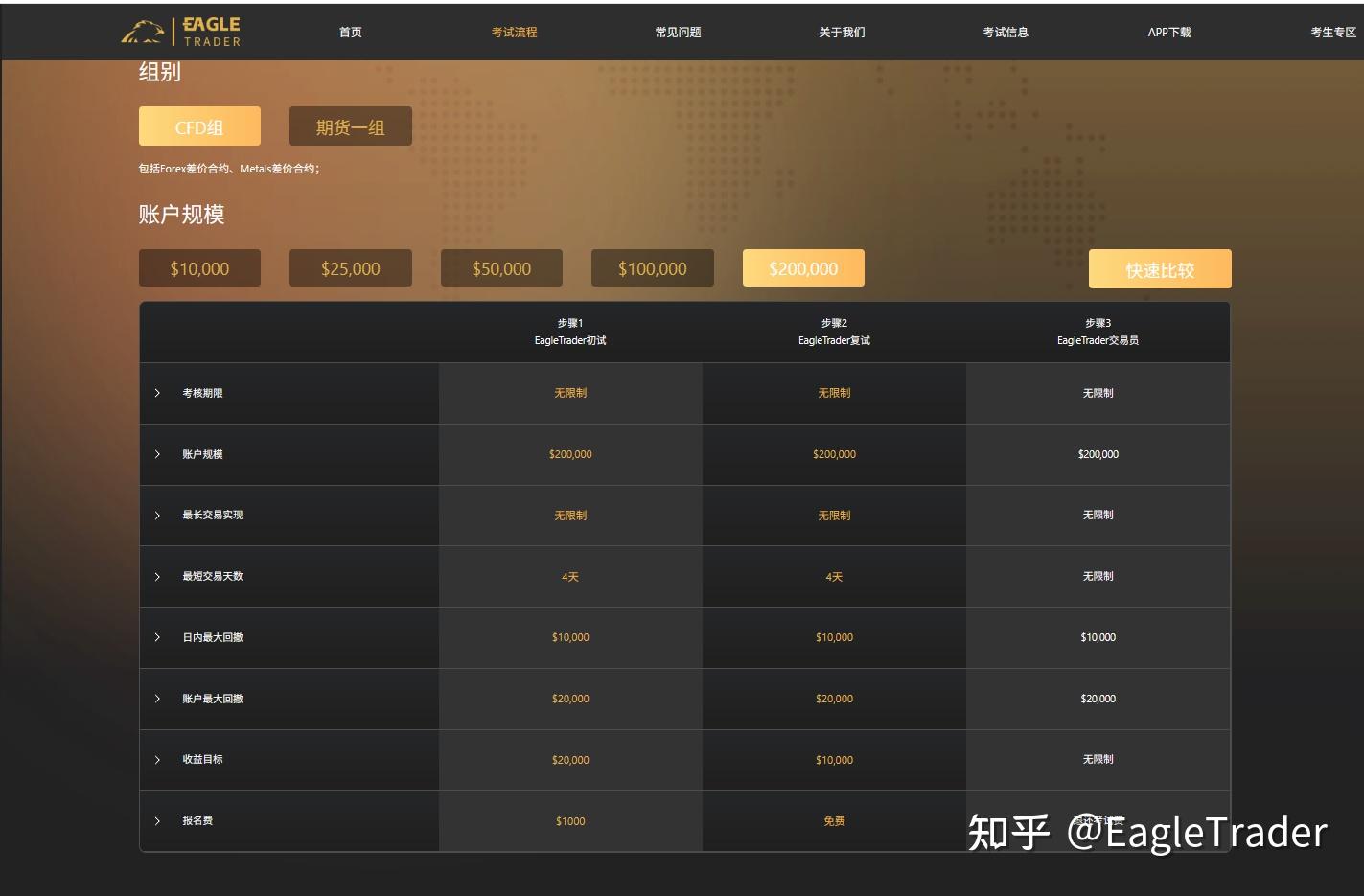

In the day’s withdrawal shall not exceed 5%

In EagleTrader, the maximum daily loss amount of the account is 5% of the initial funds. This amount is reset every day at the opening (6 am Beijing time in the summer and 7 am in the winter and will not increase due to account profits. The calculation of losses not only includes closing orders, but also floating losses in positions, as well as handling fees and overnight interest. Once the loss exceeds this limit, the exam will be considered a failure.

For an example:

If you are using a demo account with a scale of 200,000 US dollars, you can lose up to 10,000 US dollars a day. Even if you made 50,000 yesterday, you can still lose 10,000 today. If you exceed it, risk control will be triggered.

This is also where many people are “unexpectedly out”. For example, if your daytime closing order has lost 3% of the principal, then the floating loss and handling fees of the newly opened position can only lose 2% of the principal at most.

If the operation is not smooth, it is best to stop decisively when the loss is close to 3%-4%, rather than hold on to the last little space. Because as long as the market fluctuates a little more or the closing moves are a little slower, you may directly cross the line.

Total retracement shall not exceed 10%

In the EagleTrader exam, the total retracement rules require the candidates to always maintain the net value of their account at least 90% of the initial funds.

For example:

Suppose you have an account of $200,000, and the early operation is smooth, and the account has reached 250,000 to 250,000. At this time, your retracement space is even greater: even if you lose back the 50,000 you made before and lose another 20,000, as long as the net value remains above 180,000, it is in line with the total retracement rule.

The focus of the total retracement rule is long-term fund management. It does not examine whether traders can seize a big market in the short term, but how you can effectively manage risks throughout the entire examination cycle. Many traders think that there is a profit buffer, so they can increase their positions at will. As a result, the loss speed is too fast, and they fall below the red line in one breath, and the exam will end early.

Why Eagl eTrader needs to set these two risk control standards?

In the EagleTrader examination system, intraday drawdown and total drawdown are not simply restrictive terms, but an examination of traders’ real risk control capabilities.

Intraday drawdown reflects traders’ response to short-term fluctuations. The market has uncertainty every day. Setting a single-day maximum loss line can prevent candidates from “exploding positions in one day” in emotional or extreme markets, ensuring that they have the ability to stop losses in a timely manner and control risks on the day.

Total drawdown corresponds to longer-term fund management capabilities. Even if traders perform well in the short term, if the overall drawdown is too large, it still means insufficient fund tolerance and lack stability in strategy. A 10% total drawdown line is a hard requirement for long-term stability.

Therefore, these two risk control standards are combined to examine whether traders can maintain the bottom line in a single day, and whether they can maintain funds safety in the exam.

This is exactly the same as the logic of real capital management: capital parties will not relax risk control because of short-term profits, nor will they tolerate large drawdowns. For traders, such training can help you develop professional risk management habits in advance and be able to be at ease when facing larger funds in the future.

How to maintain the bottom line of withdrawal?

1. Stop decisively when approaching the loss warning line

When the loss is approaching 3%-4% that day, don’t stand it. Leave some space for yourself to avoid intraday retracement caused by temporary operational errors and end the exam early.

2. Control your position and stay overnight with caution

Don’t overnight orders seem calm, but in fact, overnight fees and opening spreads may cause unexpected losses to the account. Only by reasonably controlling positions can we reduce the risk of being eliminated by “invisible killers”.

3. Protect profits and prevent the account from retreating to the bottom line

When the account is already profitable, pay attention to risk management. Don’t let the net value give up to the bottom line of the total retracement, otherwise the early efforts may be in vain.

4. Intraday discipline + total retracement management combined

Combining daily operational discipline with the retracement rules throughout the cycle, you will find that the account is more stable, the transaction is more rhythmic, and it is easier to pass the exam.

In the market, traders who can truly go long are often not because of high returns again and again, but because they can stabilize their position on the brink of risk. EagleTrader sets intraday and total retracement restrictions, which seems strict, but it just allows traders to complete training in “balance between risk and return”.

Such training will force you to face up to capital management instead of just focusing on short-term profits and losses, which means you are one step closer to a true professional trader.