630,000 yuan per month in the field: a successful model that can be copied by top traders

- 2025年8月19日

- Posted by: Eagletrader

- Category: News

630,000 yuan per month in the scene: Top traders personally teach a successful model of replication

In the self-operated trading exam, it is not only the technology, but also the mentality and execution of traders! On August 16, a group of people came in

Traders in the EagleTrader exam brought their stories to the scene in Zhengzhou – some have just passed the first exam, some have stable scores, and some have won the highest scores in August.

This EagleTrader external disk examination technical forum brings together candidates from different stages. They dismantle their exam experience and share their unique strategies here, and also ushered in a highlight moment of on-site awarding dividends. So, what is unique about this exam that global traders are concerned about? It has brought so many people to gather here?

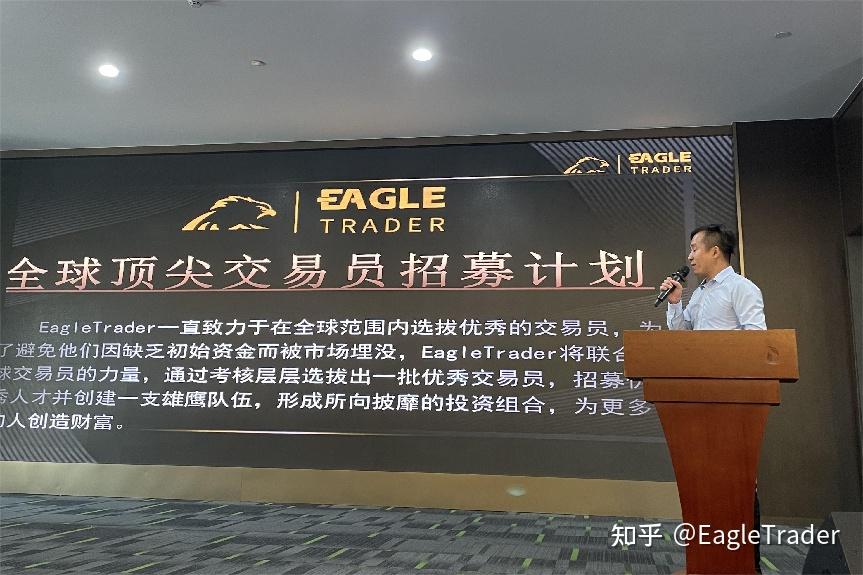

Use rules to incubate top traders

As the host of this forum and also a trader who deeply participated in the EagleTrader exam, Mr. Gao Jiangtao introduced the examination process in detail on the spot.

EagleTrader Exam is a globally oriented program for incubating top traders, divided into two stages: the preliminary examination and the re-examination. Once a trader successfully passes the two rounds of exams, he will receive the exclusive EagleTrader

Account account and you can enjoy a share of 80% of the transaction profit; if you perform well, enter the “Eagle Plan”, the share ratio can be increased to 90%.

“The rules of the exam are not to restrain you, but to verify whether you have the excellent qualities we are looking for.” Teacher Gao Jiangtao said.

In his opinion, requirements such as fund management, single transaction risk, and position duration are allThis is to allow traders to hone their stability and execution in a real risk control environment. These concepts were also vividly verified by the personal experiences of several traders on the scene.

Sharing the experience of real traders

Sprint re-examination trader—Sun Haiyang

Sun Haiyang, a trader from Shijiazhuang, has successfully passed the initial test and is sprinting for the re-examination. He admitted that what he was most unacceptable to when he first started the exam was the strict risk control rules – especially the intraday drawdown and net value fluctuation restrictions, which made him feel that he was “cannot be able to perform”.

“I used to like to chase the market and rush hard when I had the opportunity. But here, you must learn to wait.” He said with a smile. To adapt, he adjusted his strategy, focused on the quality of volatility rather than the amplitude of volatility, and set strict entry and exit standards.

“The rules have to calm down, but it is easier for me to make rational decisions.” He believes that the key to the re-examination lies in long-term stability, and “whether the discipline can be maintained for several consecutive months is the real test.”

Trader Liu Wenke

Trader Liu Wenke from the diversification stage uses his original method – “pregnancy line technology”

Bringed to the forum site. He explained in detail the entire process from form recognition to practical application, and shared his experience in the transaction and his adjustment strategies. Many traders took out their mobile phone records on the spot and learned how to implement the theory.

Liu Wenke also specifically reminds everyone that splitting is only a phased achievement, and more importantly, it is to continuously verify and optimize strategies in long-term transactions.

Failed to the profit-dividing trader——Jo Qiao

The Qiao Qiao trader in Luoyang shared a sharp contrasting story. When she first shared the profit, she achieved good results with her strategy, but then she failed to continue due to her lax mentality and lack of rigorous execution.

She frankly reviewed the mistakes, psychological fluctuations at that time, and how to summarize experience and adjust strategies afterwards, and also shared her experience: “Stable profits are the ones that best reflect trading ability.” Qiao Qiao’s real experience resonated with the on-site traders and also triggered the on-site thinking.

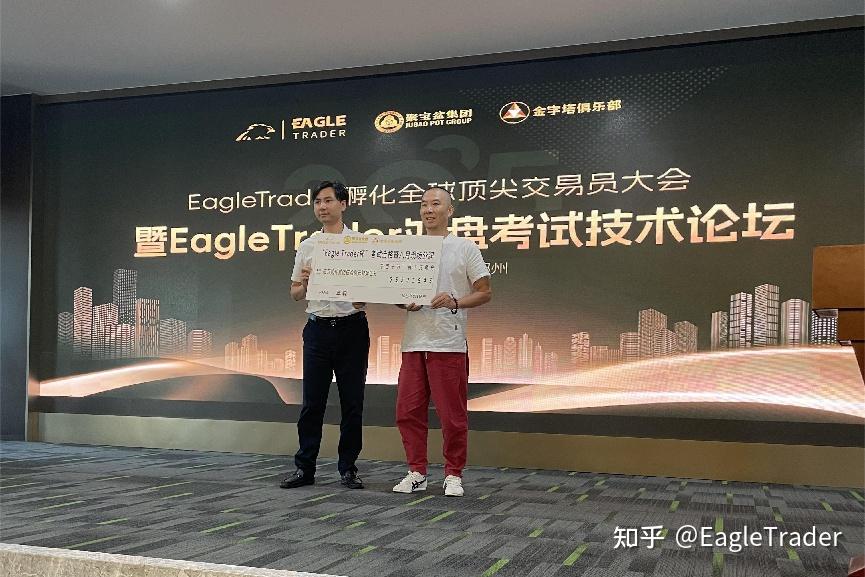

Online award of Fenrun

In addition to the sharing of several outstanding traders, we also specially invited two traders from the top three Fenrun rankings in August to receive rewards on site.

The one with the highest profit share in August

<img alt="" src="https://www.hudianbaoseo.cn/uploads/allimg/20250819/1755566375756253.jpg" width="654" height="436"//

Zhang Hongfa, whose first profit share reached 36,000 was the first single account profit share in August. He shared that the most important thing to enter this exam is to pay attention to risk control: control positions, try to use small positions, and learn to short positions, because large market conditions are not available every day.

He emphasized that trading should not be frequent, and the examination results do not need to be too anxious. Instead, you should combine international news and important data to judge the market direction, formulate your own trading plan and strictly implement it, and just bring a stop loss.

Eagle Plan Fenrun Candidates

The second place in this Fenrun is Zhang Sen, a candidate for Fenrun of the Eagle Plan. He now has two accounts that have entered the Fenrun stage. He reviewed his experience on the spot: inadequate risk control leads to a large drawdown. When a good opportunity comes, there is insufficient funds and it is almost impossible to return to the original net value.

He concluded: “Risk control is the most important thing. Only by strictly implementing risk control can you avoid being passive. Be patient and wait for the opportunity you truly understand before taking action.” Zhang Sen’s experience made the traders present deeply feel that risk control and patience are one of the important factors for the success of the exam.

This forum is not only a exchange of technology and experience, but also an in-depth course on mentality, discipline and risk control. Whether it is the first test, the second test, or the traders who have entered the profit-dividing stage, their stories point to the same core – stability and execution, which are the real passes to professional traders through the EagleTrader exam.

EagleTrader uses rules to incubate, polish with practice, and empower with support, so that more potential traders can grow in a real market environment. As many traders on the forum said, the exam is just the starting point, the real challenges and opportunities, and waiting for everyone who dares to persist on the broader trading road.