At EagleTrader, every failure will be your chip to turn the tables

- 2025年7月21日

- Posted by: Eagletrader

- Category: News

On the road to trading, no one wants to talk about failure easily. But failure is the part that every trader will eventually experience.

It sometimes makes people fall into self-doubt, sometimes arouses anger – you may be confused by the market, feel dissatisfied with the rules, and even refuse to accept the results in front of you for a while.

The frustration often comes violently and lasts, making people unable to let go. But what really widens the gap between people is not failure itself, but the attitude you choose to get out of failure: is it crushed by it, or treat it as an opportunity to reshape yourself?

Failure is the norm

Failure does not mean that you are not outstanding enough. It shows more that you have reached a bottleneck at some stage—may be technical, or psychological or emotional. It is these places that “stuck” you quietly point in the direction you can break through.

Failure is more likely to reveal the true quality of your trading system than success: can you still execute your plan while losing continuously? Can you maintain position control in emotional sway? Do you really understand the tension between risk and confidence?

You are more likely to find answers to these questions from failure than success again and again. And once you find the answers, they will lay the foundation for your next progress.

What can the EagleTrader test teach you?

EagleTrader test is not only a test of rules and transactions, but also a profound process of self-understanding. It will expose your true reactions under stress, such as emotions and decision-making patterns when you lose money, which also prompts you to learn to stay calm in trading.

Through this exam process, you will verify whether you truly trust and strictly implement the established trading system, even in the context of adverse markets. At the same time, this will also help you realize how you unknowingly deviate from your original plan in actual transactions.

You will find those “self-data” that are easy to ignore in trading:

When will you rushAct and when to stay disciplined;

How to deal with retracements, limits, break-even or small profits;

When do you enter based on strategy, and when is an emotionally driven entry.

How to digest failure and prepare for the next time?

Failed does not mean that you are incompetent. Instead, it often means that you have gained a piece of the most valuable thing: feedback from practice and real experience.

If you know how to digest and utilize these, they will make your next practice more mature and more testable.

Many traders are eager to commit to new challenges after encountering setbacks. That motivation is worthy of recognition, but if there is no real reflection, many decisions may just repeat the last impulse.

Ask yourself:

What was the root cause of the last failure?

What is my advantage and how do I use it?

Do I re-form a new plan or continue to try again as the old method?

Are you able to answer these questions now? Or do you want to leave a few days to calm down and organize your ideas?

In transactions, a real restart is never a simple “try again”. It means you have a deeper understanding of failure and it also means you start to know yourself in a different way.

The next transaction is not necessarily just a correction of the old error, but more likely an upgrade of your trading system perception. Because only after experiencing real setbacks can one realize what is the judgment method they really rely on, and which are just blind spots deceived by luck and inertia.

Many times, failure will not give an answer immediately, but it will gradually strip away your fantasies about the market and yourself. True progress happens precisely after these disillusions.

So, when you are ready to go back, remember: that’s not just starting over, but moving forward in a more realistic and sober way.

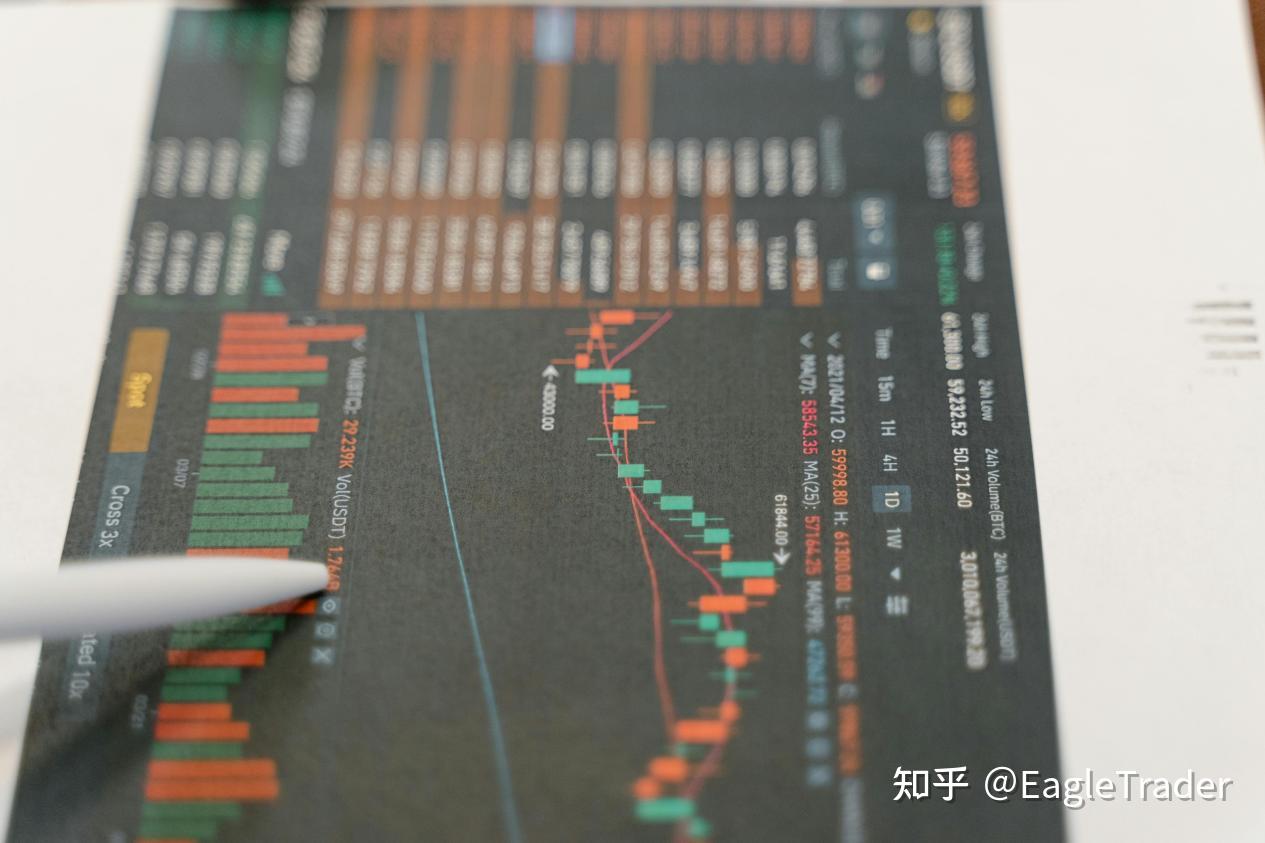

Review and Analysis

When the initial disappointment gradually fades, will failure become the root cause of your stagnation, or

What is the driving force that drives your progress? This decisive moment is precisely the time for data review and reflection. Simply saying “this doesn’t work” is not enough, but more importantly, understanding why it doesn’t work. When reviewing, you should not only pay attention to the fluctuations of emotions, but also the information conveyed behind the data.

When reviewing, focus on the following key indicators:

RRR (risk-return ratio): Is your potential profit to risk proportion in line with the strategy? Or are you often enter the market with an unbalanced risk-return ratio driven by emotions?

Win rate and effectiveness: Is your winning rate very high, but the overall profit is not ideal? Or do you have few profitable transactions, but each return is high? The balance of these indicators reveals the long-term sustainability of your strategy.

Maximum retracement: How does the maximum loss occur and what causes it? Is it a mistake or a series of rules violating?

Daily limit: Does the daily loss limit exceed? This may indicate that your trading plan is not comprehensive, or you are forcibly “making back” the loss.

Trading timing: When is the most prone time you make mistakes? Is it in the morning, afternoon, or after continuous losses? These models can help you better plan the trading rhythm.

Are you ready to try again?

Faith in the EagleTrader exam may not be the end point, it is more likely to be a valuable asset on your trading growth.

If you are willing to treat it as an opportunity for self-reflection, the changes it brings may be more profound than success – you will truly understand your reactions under pressure, the motivations behind impulses, and whether you can stick to your trading plan.

All of this may be the most fundamental difference between a trader who “just trade” and a trader who “consciously trade”.

So, don’t define you by temporary results. You have taken the first step to change. Next time, please start again with new cognition instead of doubt! EagleTrader will always be here to witness your breakthroughs and growth.

From July 15th to August 15th, the registration for EagleTrader Anniversary Limited-time offer is underway. Perhaps this is the best opportunity to reappear and verify your trading ability!