Breaking the randomness of returns: How to use rules to force stable profit potential in the self-operated trading exam

- 2025年6月12日

- Posted by: Eagletrader

- Category: News

As a trader, whether you can make continuous and stable profits has always been the core standard for testing trading capabilities. However, in the real market, many traders find that their trading results often have obvious “randomness”: they are familiar with the technical forms and clear concepts, but once they operate in real market, their reactions are always slower than the market, and operations are often driven by emotions. Such scenarios are common for decision-making to chase ups and sell downs, positions are out of control, and plans are left behind.

Faced with this dilemma of “it is easy to know and difficult to do”, a new trading method – the self-operated trading exam is becoming a tool to help traders break bottlenecks.

Rules are the foundation of stable profits

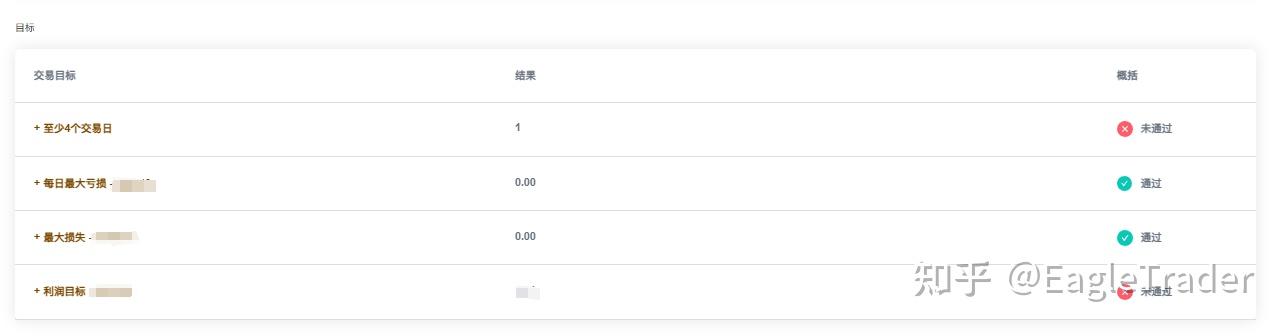

Unlike conventional trading, the essence of the self-operated trading exam is to measure trading capabilities with specific rules in the environment of “simulating the real market”. The examination account is provided by the platform to simulate funds. Traders do not need to invest principal, but must strictly abide by the risk control framework: including intraday loss restrictions, maximum drawdowns, and the proportion of single risk exposure. These rules are on the surface, but in fact they are questioning the trading logic.

Many traders only realize after taking the exam that there are “non-systemic” loopholes hidden in the operating methods they are used to. For example:

The direction of heavy gambling is actually an implicit impulse to not limit the stop loss;

Frequent trading is not a strategic setting, but a psychological compensation; trying to turn the book after a drawdown actually deviates from the original trading plan.

EagleTrader Proprietary Trading Examination uses rules to expose these behaviors one by one and prompts traders to rebuild trading systems within a compliant framework.

Trader’s True Feedback

So, can such a set of constraints really help traders get rid of “random profitability”? Compared with the platform’s self-report, what is more convincing is feedback from witnesses.

In the EagleTrader trader interview column, many traders who passed the exam admitted:

“The rules and mechanism of the EagleTrader test can be well improved.Our trading strategies can also eliminate our emotional operations, so it is what we need to do to incorporate trading rules into our trading system. “—Trader Liu “The biggest gain of participating in the EagleTrader exam is that under the constraints of the rules, you can adjust your own behavior, control your positions, and not bet on data to reduce orders, and frequency. ”—Trader Li

”After the exam, I implemented my strategy more carefully and began to put risk control first. ”—Trader Deng

“My biggest gain in the exam is to learn better fund management and keep the principal and have the opportunity to make a profit. “——Trader Luo

These feedback is not a simple report of successful experience, but a real record of confrontation with oneself during the participation process. The self-operated trading exam is not about who makes a profit faster, but about who can live long and go far under the rules.

Monetization of trading capabilities

The biggest attraction of the self-operated trading exam is the profit incentive after clearance. The essence of trading is profitability, so for traders with real strength, this is not only a verification of their ability, but also an opportunity to achieve profits.

After passing two rounds of assessment, traders will obtain a new demo account. In order to encourage traders to continue to abide by the rules and make stable profits, the platform will give 80% of the profits based on the account

profit sharing. When traders show higher stability under rules constraints, they can also unlock the next stage of challenges, earning up to 90% of profit share.

It is worth mentioning that the exam itself is not a “cost center”: the registration fee for clearancers will be fully refunded. In other words, as long as you have the ability, you can complete a “profitability certification” at zero cost.

This mechanism not only avoids the financial risks in real-time trading, but also closely links returns with capabilities, exploring a sustainable trading professional path.

Trading is not a game, and profit cannot be achieved by luck. The EagleTrader self-operated trading exam is a controlled, transparent and traceable training and evaluation system. It strips away emotional influences, restrains impulsive behavior, and forces traders to find the most stable profit model that suits them under strict restrictions.

In this increasingly “quantitative” and “rational” trading world, the core of trading ability is no longer the halo of profit, but the long-term replicable stability.

Instead of repeatedly trying and making mistakes in the market, it is better to see yourself clearly in the rules system. The “real skill” you want may be hidden in every examThe number of times is in limit.