How did he use “engineering thinking” to stabilize the retracement in the ET exam without having systematically learned trading?

- 2025年12月8日

- Posted by: Eagletrader

- Category: News

For most traders, “freedom” is the most tempting starting point, but it is also the place where people are most likely to get lost. What truly makes trading mature is never passion, but rhythm, self-discipline and a system that is willing to be tested.

<img alt="" src="https://www.hudianbaoseo.cn/uploads/allimg/20251208/1765158430162635.jpg" width="654" height = 343

Finally, the originally loose personal transactions were brought into a clearer and more controllable framework.

From engineering to trading

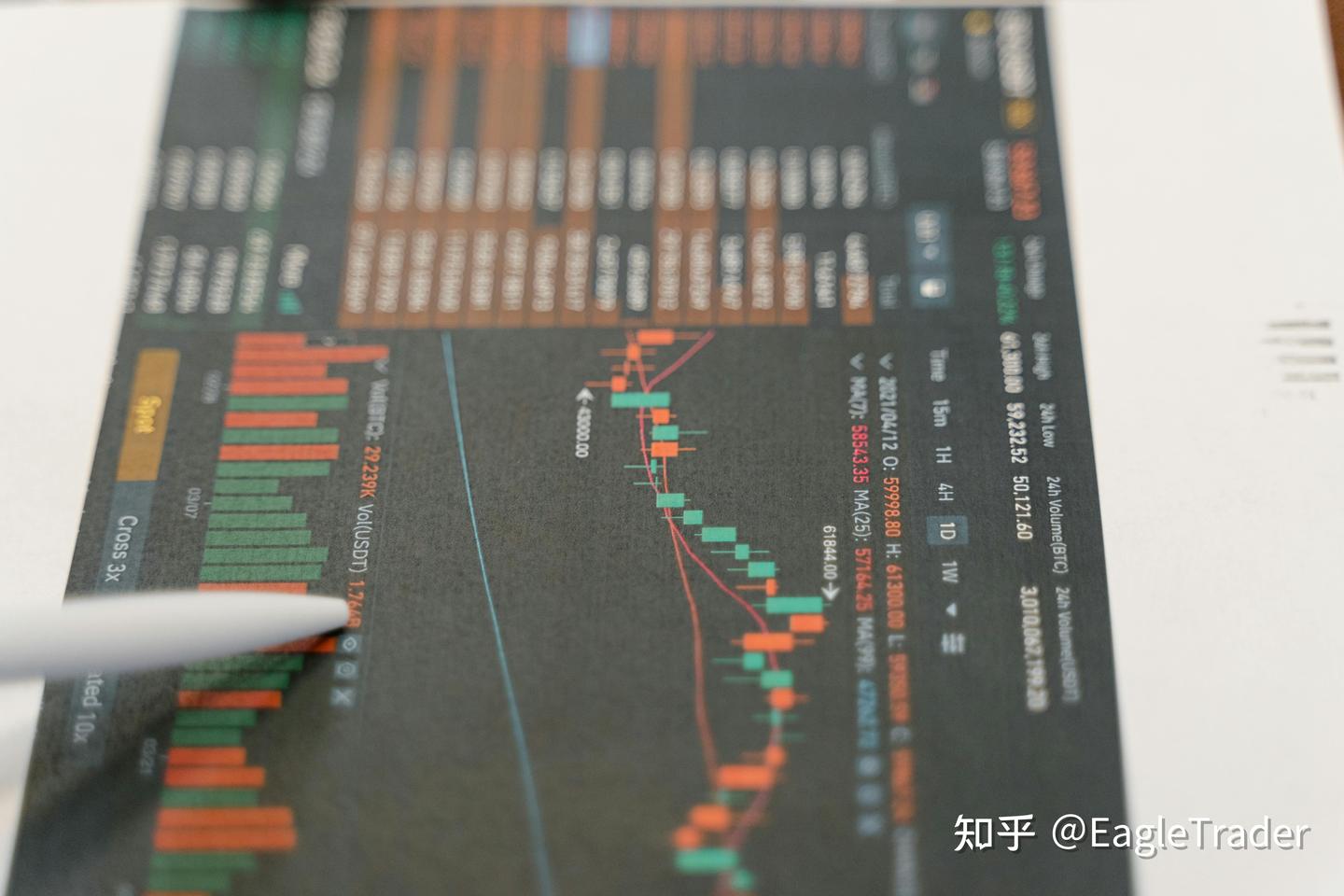

The work rhythm in the engineering industry is relatively flexible, allowing Jin Xu to retain “space to keep an eye on the market” outside of work. In college, he started to get involved with stocks and virtual currencies due to the influence of friends, starting from the most basic

K-line research begins, and almost all experience comes from trial and error with real accounts.

“I have basically never learned trading systematically, and I have all relied on myself to explore in the real market.” In the past eight or nine years, he has experienced the rapid rise and violent fluctuations of the market, and has also experienced the mental damage caused by continuous losses. The blow on the trading road did not make him quit, but made him gradually realize that stability does not come from frequent moves, but from clear-structured logic and grasp of rhythm.

This year, he began to try the foreign exchange market. In his opinion, the varieties are different but the logic is the same: “We all look at the K-line and the rhythm, but the trading time of foreign exchange is longer and requires more energy.”

Why choose ET?

Jin Xu first saw ET related content in Xiaohongshu. He was cautious and didn’t sign up immediately. It wasn’t until he participated in ET’s offline event in Xiamen that he really started.Understand this assessment system. However, he still did not sign up after the event: “The rules are strict and the fees are high. I’m afraid I’m not ready.”

But the more he looked back at his past transactions, the more he realized a problem – “I’m too used to doing things my own way, but that way won’t let me break through.”

As his self-confidence gradually increased, he re-examined ET Assessment mechanism:

1. Retracement limits make risk management an inevitable step in trading;

2. Clear rules reduce room for hesitation and make execution cleaner;

3. Fees will be returned after passing the exam, making trial and error costs reasonable and controllable.

In the end, he chose to sign up. The next challenge allowed him to truly experience the pressure and growth brought about by strict rules. “During that time, I was obviously more cautious and had a much stronger awareness of risk control.” Jin Xu recalled.

And this ability to improve within constraints was quickly verified – he successfully obtained a profit share of US$2,600 in ET.

He also spoke highly of ET’s localized services and offline activities. He admitted that he had learned about overseas props

firm, but has never tried, “The domestic platform still understands the habits of domestic traders better.”

The daily rhythm of profit sharing trading

Jin Xu’s pace of life has its own power in simplicity. His time is clearly divided into two: work and trading. On weekdays, he keeps an eye on market trends at home or between work; he works out three to four times a week to maintain a high degree of self-discipline. He doesn’t have much extra entertainment, and his life seems to revolve smoothly around transactions.

It is this extremely regular life that has become the cornerstone for him to maintain a stable trading mentality. As he himself said: “The more I do business, the more important I feel that self-discipline and a regular life are important.”

Moving closer to stable profitability

Although he is still mainly in the engineering industry, Jin Xu has a clear plan for the future: “If we can achieve long-term stable profitability, I hope to move to the whole industry.”job transaction. ”

However, he is not in a hurry to take this step. He is well aware of the complexity of the market and understands that stable profits do not rely on passion, but rely on the combination of structure, rhythm and external rules.

When asked why he prefers ET, his idea is simple: “He understands domestic traders better, the rules are clear, and he is more practical. “The sense of stability he pursues is precisely what many traders value most when choosing a self-operated platform.

Find confidence in simulation first

For those traders who are preparing to challenge the self-operated exam, Jin Xu gave an extremely critical path: start with simulation and let confidence come before paying.

He suggested: “Build confidence in free simulated trading first, and then sign up for the exam. Don’t rush to sign up impulsively. Make sure you are sure of your operation first. ”

<img alt="" src="https://www.hudianbaoseo.cn/uploads/allimg/20251208/1765158444150168.jpg" width="654" height = 316 Consciousness constitutes an important quality for a trader's stable core.

As he learned in the ET exam: through repeated polishing under a clear framework and risk constraints, the possibility of stable profits will quietly increase.

If you are looking for a clearer, more standardized and more suitable trading path for long-term development, maybe you can start with a rigorous exam like Jin Xu!