How fatal is insufficient funds to traders? Maybe you should understand the self-operated trading exam

- 2025年7月11日

- Posted by: Eagletrader

- Category: News

Traders often face an important problem in the market, that is, insufficient funds. Whether it is a novice trader or an experienced veteran, funding restrictions often restrict trading decisions to external conditions, which affects the trader’s overall profitability and psychological state. So, what impact does insufficient funds have on traders? How to solve this dilemma?

The impact of insufficient funds on traders

Trading opportunities are limited

Insufficient funds reduce the amount of operational funds of traders, which directly leads to them being unable to seize larger profit opportunities. The shortage of funds limits their trading frequency and position choices, which leads to traders often being able to participate in some low-risk, low-return transactions.

Risk Management Challenges

Without enough funds, traders cannot effectively diversify their investments, and risks are concentrated on a single position. Once the market fluctuates violently, traders with insufficient funds may be unable to bear the losses and may even be forced to close their positions. At this time, they may make more impulsive decisions, such as irrational behaviors such as increasing positions and buying at the bottom.

Excessive psychological pressure

Faced with the tension of funds, the psychological burden of traders will also increase. In this state, they may take excessive risk actions, such as increasing leverage, frequent trading, ignoring risk management rules, etc. Although these operations may bring some returns in the short term, they will pose a threat to the security of funds in the long term.

Restricted trading strategies

The lack of funds means that traders cannot fully implement diversified trading strategies, especially some medium- and long-term strategies that require greater financial support. Such restrictions may prevent traders from fully leveraging their trading capabilities.

How to break the financial dilemma?

In order to help traders avoid the risks brought by insufficient funds, some platforms provide demo account functions, especially large-scale account operation simulation environments such as the EagleTrader self-operated trading exam, which has become the best choice for many traders.

Through the demo account, traders can use the virtual funds provided by the platform to conduct actual trading, and experience market volatility and decision-making. The most important thing is that traders do not need to trade with personal funds, so that they can get rid of the troubles caused by insufficient funds.

At the same time, the operating environment of the demo account is close to the real market, which can help traders accumulate valuable practical experience. Some platforms will even give dividend incentives. Even if they use a demo account, they still have real returns.

The advantages of the self-operated trading exam

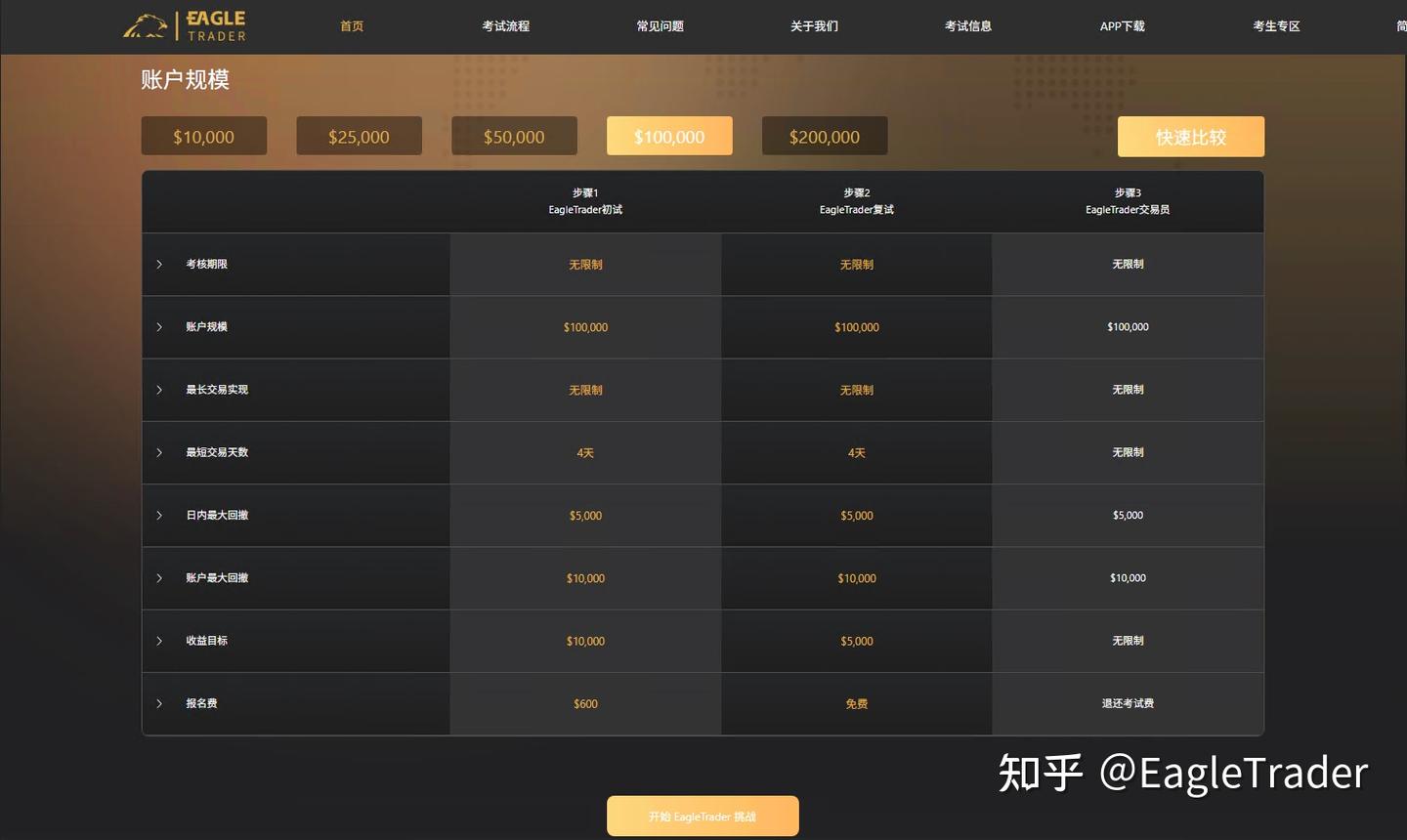

For traders who are tight in funds but are eager to prove themselves, like EagleTrader

The self-operated trading exams provided are gradually becoming a pragmatic choice. The examination uses the simulated fund account provided by the platform, and traders do not have to deposit and trade, so they can start trading in a simulated real market environment. More importantly, the self-operated trading exam also has clear risk control standards and trading rules, such as maximum drawdown restrictions, position holding discipline, etc. This is not only the standard of the exam, but also the constraint mechanism for trading behavior.

This means that traders can test their strategies, train their execution capabilities without financial pressure, and even correct some out-of-control behaviors such as frequent positions increase and heavy positions gambling in the rule framework.

When traders show stable trading ability in such an environment, they can also enter the profit sharing stage of EagleTrader, obtain financial incentives based on actual profits, and obtain career development opportunities in further assessments, achieving an orderly transition from demo accounts to professional trading.

The shortage of funds is certainly a threshold on the trading road, but it should not be the ceiling that hinders growth. What really determines whether a trader can go far is never the balance of the account, but the choice when dealing with difficulties. If you are limited in reality, you might as well train it in the rules; accumulate strength in simulation to lay a solid foundation for realizing profit sharing and moving towards professionalization.

For every trader who is eager to break through, perhaps what you lack is not ability, but a platform that allows you to give it a try. And now, the opportunity is in front of you, and the next step is your turn to decide. Start here, accumulate achievements, win opportunities, and reshape your trading life!