How to go against the wind and make steady profits in the zigzag market?

- 2025年7月23日

- Posted by: Eagletrader

- Category: News

As traders, we often encounter repeated fluctuations in market trends. Sometimes, the market price is like a sawtooth knife, fluctuating continuously and elusive. This situation is called the “jagged pattern”, which often appears in short-term charts, putting many traders in trouble, especially traders who lack systematic strategies and strict risk control.

Understanding the characteristics of serrated patterns and how to deal with this market volatility will not only help you avoid losses in actual trading, but also provide you with a solid knowledge base in the EagleTrader self-operated trading exam.

Saw tooth pattern: the market’s “shaking”

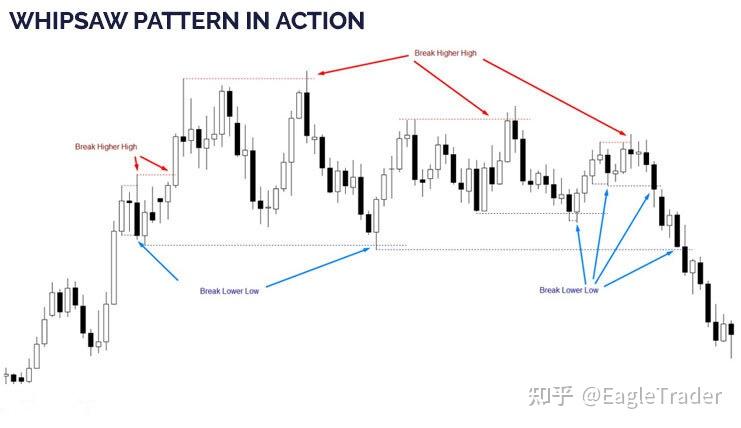

Suppose the price breaks through a new high, the market seems to strengthen, and traders are pouring in. However, the price suddenly reversed and began to fall. At this time, some traders may consider it a “false breakthrough” and follow the market’s reverse operation.

At this time, the market fluctuations may be more intense, resulting in traders who open positions in false breakthroughs being forced to close positions. And while they close their positions, the market may rebound, breaking through the previous highs, causing short traders to lose money. With such repeated fluctuations, the market trend has shown a typical “jagged-tooth pattern”.

This fluctuation is particularly prone to short-term charts (such as 1 minute, 15 minutes, 1 hour), but may also be particularly obvious on daily or weekly charts. This capricious trend is extremely confusing and can easily cause traders to fall into traps and cause losses.

For self-operated trading exams like EagleTrader that simulates real market environments, understanding and dealing with this zigzag pattern is a key skill that every trader must master.

Understanding the market motivation behind jagged patterns

Two types of transactions in the market at these key pricesThe person—one is a trader with firm intentions, and the other is a trader who lacks motivation and conducts temptations in the short term—collects violently. This conflict is the root cause of market volatility. Orders are constantly tested and adjusted through market injection and hedging, and the two sides compete repeatedly in the market until the direction is finally decided.

These collisions not only cause severe price fluctuations, but most of the time, they are formed in lower and higher time frames. Ordinary traders often find it difficult to deal with this market chaos, and are easily “sanded in the middle” and encounter stop loss.

How to stand out in the jagged pattern market?

When facing the jagged pattern market, there are several important trading skills that every trader needs to master. These skills will not only help you avoid losses in real-time trading, but also improve your success rate in EagleTrader’s proprietary trading exam.

Rely on multi-time period analysis

This is the fundamental reason for survival. You must obtain a comprehensive perspective in different time cycles and build a comprehensive understanding of the market. If the short-term trend is bullish and the long-term trend is bearish, then you are likely to fall into confusion. Only by combining charts of different time cycles can we accurately grasp the overall trend of the market.

Adjust the stop loss point

If you find yourself trapped in a jagged pattern, adjusting the stop loss point appropriately is one of the strategies to avoid losses. Set the stop loss a little further, giving yourself more time and space to deal with market fluctuations. Through multi-time period analysis, your stop loss point setting will be more scientific and increase profit opportunities.

Keep calm and confident

Staying calm is crucial when encountering jagged patterns. Don’t rush to withdraw your position, and don’t set the stop loss too close. Try to leave enough room for volatility for yourself, but always keep in mind the principles of risk management. The jagged pattern usually expands to a larger range, so you may have to take greater risks. Stay confident and rely on analysis to solve this tricky situation.

High vigilance and continuous assessment

This is the time when you should least relax your vigilance. In order to avoid blindly setting stop loss or take profit, you need to always pay attention to market changes and respond quickly to price trends. The uncertainty brought by the zigzag pattern requires you to constantly check the market and update your judgment.

Leave the market if you can’t cope

Exit may be the best choice when you realize you are being troubled by the zigzag pattern of the market. If you don’t have enough patience and energy to deal with these fluctuations, consider selling at a breakeven position. Always remember that there will be other better opportunities in the market. If this chaotic “storm”If you can’t survive, it’s best to wait for the market to stabilize before taking action.

Market volatility does not always occur in the simple pattern we expect. Through our understanding of the zigzag pattern, we can better adapt to these complex market changes. In EagleTrader’s self-operated trading exam, we encourage every trader to have an in-depth understanding of market behavior and cultivate the ability to deal with market chaos such as zigzag patterns.

EagleTrader not only provides a real simulated trading environment, allowing you to practice trading without financial risks, but also passes a systematic examination process to help you grow rapidly in trading. By successfully passing the EagleTrader’s proprietary trading exam, you will have the opportunity to receive the funds provided and demonstrate your trading strength.

At EagleTrader, we believe that every trader can stand out in the market through continuous learning and practice. Join us and start your trading journey!