Is EagleTrader self-operated trading exam really an ideal path for traders to break through?

- 2025年6月20日

- Posted by: Eagletrader

- Category: News

Most traders on the market fight alone as retail investors. Compared with professional traders, they lack resource support, feedback system, and even less channel to show trading capabilities.

In order to find a trading system that suits them, many individual traders can only try and make repeated trials and errors with their own funds. Even if the enthusiasm for trading remains unabated, the cost is often high.

In this context, the self-operated trading exam based on simulated funds quickly attracted the attention of a large number of traders. This mechanism is different from the practice mode of purely simulated trading, and is also different from the high requirements for funds in real trading.

It establishes an intermediate mechanism of “for opportunities with ability” – which is very attractive to traders who have a certain trading foundation but have not yet completed their professional leap.

But the question also follows: Is this exam mechanism really reliable? Is it suitable for everyone? Is it worth investing time? If you are also looking for higher-level trading paths, perhaps this article can help you clarify your ideas.

Why does the trading environment limit you

The failure of most traders is not due to poor strategy, but is limited by the trading environment:

The funds have weak risk resistance

The scale of funds is small, and a slight drawdown will affect your mentality, making it difficult to execute the complete trading logic, and being difficult to withstand the repetition in the strategy optimization process.

Lack of feedback system

Retail traders are often in a cycle of “I think I’m OK” and “Why am I always wrong”. Without system records and external evaluation, it is difficult to truly improve the transaction level.

Lack of display channels

Trading is a result-oriented industry. Without performance display, it is difficult to gain recognition and connect to larger resources and platforms.

The self-operated trading exam tries to fundamentally solve these three major problems. By setting a low-threshold simulated fund participation mechanism, introducing institutionalized risk control and evaluation standards, and linking trading performance with profit sharing incentives, traders are provided with a new channel for structured growth.

Four advantages of self-operated trading exam

1. Simulated funds leverage real returns

Simulated funds are used for trading during the exam. After passing the assessment, real income sharing will be obtained based on the profit results of the new account. For traders with limited funds, this is a cost-effective growth leverage.

2. Discipline forces strategy optimization

Owned trading exams often set clear risk control lines, such as maximum drawdown, single-day loss upper limit, etc., which forces traders to adjust their strategies under the risk framework to improve stability. It is for the first time that many traders truly experience the changes brought about by discipline in the exam.

3. Quantitative feedback improves self-cognition

The evaluation mechanism no longer relies on personal feelings, but instead scores through multi-dimensional quantitative indicators such as account curve, retracement, profit-to-loss ratio, and position cycle, providing traders with objective data that can be reviewed and sustainable optimization. After passing the score, you can get a profit-sharing account or career position. 4. Connect career resources and development paths. Outstanding candidates can not only get a profit-sharing account, but also have the opportunity to get larger-scale financial support and career position invitations. This examination mechanism has gradually become an important channel for some professional trading institutions to screen talents.

Who is suitable for the self-operated trading exam?

Traders with foundation but limited funds

If you already have a certain winning rate and risk control awareness in a small capital account or simulated trading, but lack a display platform, the self-operated trading exam can set up a promotion channel for you.

Traders with strategy but lack execution

Everything has exploded due to emotional increase and frequent betting? The discipline mechanism of the exam will be a training ground for correcting these problems.

Traders who want to move towards professionalism

Whether they want to join a professional team or become a long-term and stable independent trader, the proprietary trading exam provides a recordable, quantifiable and displayable growth platform.

Part-time traders with potential but limited energy

If you are unable to trade full-time for the time being, the flexible participation methods and remote evaluation process of the self-operated trading exam also retain the possibility of participating in the trading industry.

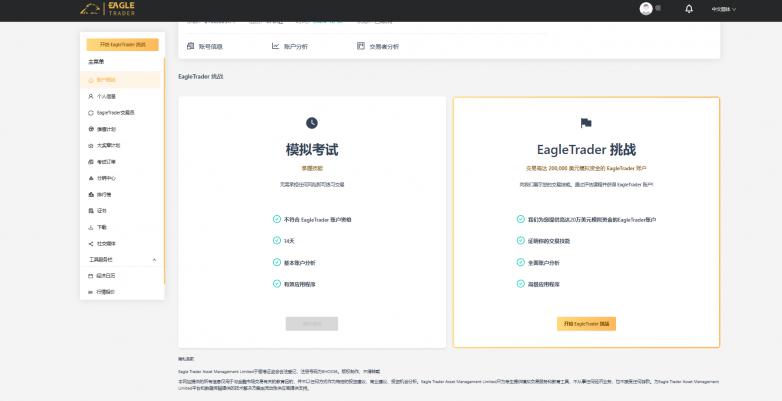

EagleTrader mechanism reference

Take the relatively mature EagleTrader self-operated trading exam on the market as an example, its mechanism has achieved a complete closed loop from assessment to occupation:

Use simulated funds throughout the exam to avoid individuals taking risks

Through the assessment, you can obtain a profit share account, and the income share ratio can reach up to 90%

EvaluationThe dimension covers the details of profit and loss ratio, maximum drawdown, risk control compliance rate, etc.

Excellent candidates can obtain further development opportunities such as fund scale expansion and job invitation

Overall, the self-operated trading exam is not a simple screening game, but provides a chance for traders who are not seen, dare not take risks, but are still eager to break through – exchange abilities for resources and rules for freedom.