Running the factory during the day and keeping an eye on the business at night: How did a food factory manager get $4,000 in profit sharing for the first time?

- 2025年12月22日

- Posted by: Eagletrader

- Category: News

For many traders, the real difficulty is never “not understanding the market”, but how to maintain restraint and consistency in the long, repetitive, unsupervised trading process.

Xie Xiaoqiao has a deep understanding of this. He is not a “full-time trader” in the typical sense. During the day, he managed a food factory in Sichuan; at night, during a relatively quiet time, he opened the trading software and entered the market. This seemingly unrelated dual identity gave him a particularly clear understanding of “trading discipline” and “risk boundaries.”

From stocks and futures to proprietary trading

Similar to many traders, Xie Xiaoqiao’s trading journey began in stocks and then moved to futures, which lasted more than ten years. He has not received systematic training, and mainly relies on self-study to complete the accumulation of trading abilities: technical analysis, trading psychology, market structure, most of which come from long-term information screening and practical reflection.

“In fact, the underlying logic of stocks, futures and current proprietary trading is the same, but the rules are different.” He summarized his experience this way.

It was the “difference in rules” that made him interested when he took the EagleTrader self-operated trading exam – this was also his first exposure to the self-operated model. After learning about the exam through Xiaohongshu, he did not sign up immediately. Instead, he repeatedly confirmed the reliability of EagleTrader and even sought advice from investment friends around him. However, the feedback received was not optimistic, with many people bluntly saying that it was “untrustworthy”.

Even so, he decided to give it a try, “dubious, but controllable.”

The first failure exposed old problems

Xie Xiaoqiao failed to pass the first exam – a typical “top-up operation” caused the account to be liquidated. He did not shy away from this failure, but considered it the most critical step in the entire process.

“I originally thought I could get over it once, but I still fell into the same old habit.”

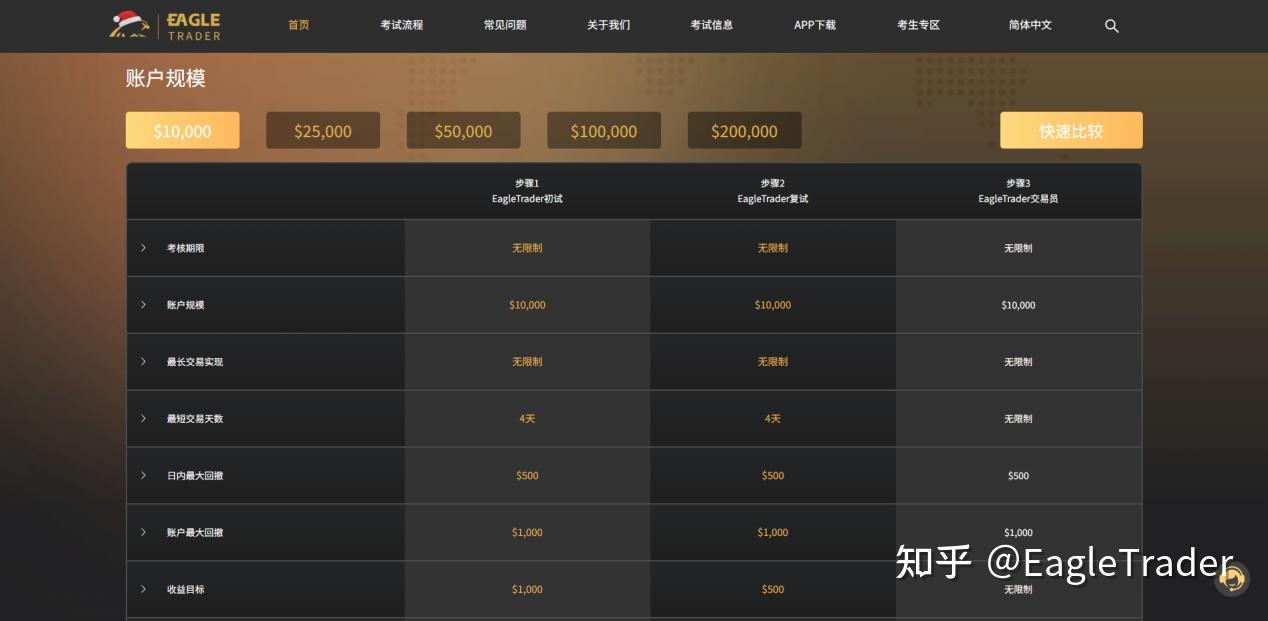

<img alt="" src="https://www.hudianbaoseo.cn/uploads/allimg/20251222/1766366179121592.jpg" width="654" height = 461 The rules of self-operated examinations clearly expose these problems.

The second time he took the exam, he obviously slowed down. The positions are lighter, the number of transactions is fewer, and the vigilance against retracement is higher. After adjusting the operation, we finally passed the assessment successfully and completed the first profit sharing.

“The profit sharing amount this time was US$4,000, and the registration fee was refunded after approval.” It was not until the funds actually arrived that he was convinced for the first time: this model “is real.”

Rules are not constraints

In the interview, Xie Xiaoqiao repeatedly mentioned a key word – rules.

Unlike real trading, proprietary trading does not allow traders to amplify risks at will, nor can they reverse the situation by “taking a gamble”. This environment forces traders to face up to their own problems.

“What shortcomings you have, the market will amplify them.”

In the absence of rule constraints, this amplification will be directly reflected in losses; in a self-operated rule environment, it will first be reflected in “you can no longer continue the operation.”

For him, this mechanism is not a restriction, but a self-correction under external constraints. It was during this process that he gradually realized the meaning of stable trading – not frequent moves, but long-term sustainability.

Both trading and management are training the same ability

As a factory manager, Xie Xiaoqiao does not think that trading and work are two completely separate things. On the contrary, he believes that the two are highly similar in terms of underlying capabilities.

It tests emotional stability, risk judgment and decision-making delay; the same is true for management work. Long-term trading experience makes him more calm and comprehensive when dealing with affairs, and management experience in turn helps him reduce impulses in trading.

“As long as there is no conflict with each other, it actually has a promoting effect. “

This dual role also allows him to maintain a rational judgment on “part-time trading”: he is not currently pursuing full-time trading, but viewing trading as a long-term investment in capabilities.

After completing the first profit sharing, Xie Xiaoqiao has signed up for a second account and has begun to pay attention to higher-level rule systems and long-term planning. He knows very well that the real difficulty in self-operated trading is not to pass the assessment, but to have the ability to continue to manage funds.

Xie Xiaoqiao’s experience actually represents a large number of traders who are in the “experienced but unstable” stage: they understand the technology, have seen the risks, and are aware of their own problems, but they still lack a trading environment that can restrain their behavior for a long time and amplify their execution ability.

For these traders, participating in a strict self-operated assessment is not just about “pursuing profits”, but also using a set of rules to verify whether they really have the ability to trade stably.