Why does EagleTrader set these rules for trading behavior?

- 2025年12月29日

- Posted by: Eagletrader

- Category: News

When learning about the EagleTrader proprietary trading exam, many traders will notice one detail: ET has relatively clear and not too loose regulatory requirements for trading behavior.

Behaviors including linked accounts, copy trading, extremely short-term operations, and non-logical hedging are all clearly restricted or prohibited.

These rules are not set arbitrarily or to “increase difficulty”, but are derived from ET’s judgment on the nature of proprietary trading assessment – what really needs to be evaluated is the trader’s independent decision-making ability, not the technical results.

ET What trading behaviors are prohibited in the proprietary trading examination?

During the examination process, ET clearly restricts the following types of behaviors:

Account association and copying operations

Candidates are prohibited from trading multiple accounts at the same time, or copying their own or others’ trading behaviors by following or calling orders.

Trading with identical strategies

Traders are not allowed to share, copy, or execute trading strategies on their behalf. If the trading characteristics between accounts are highly consistent, they will be regarded as having similar strategies.

Ultra-short-term trading

Transactions with a holding period of less than 3 minutes must not exceed a certain proportion of the total trading volume.

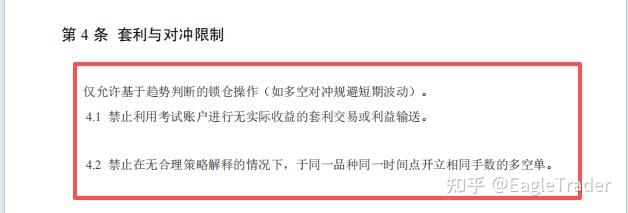

Meaningless hedging and arbitrage activities

It is prohibited to engage in hedging, trading or arbitrage operations that lack actual transaction logic just to circumvent the rules and create a stable curve.

These rules together form the trading behavior framework for the ET self-operated examination. It may seem strict, but there are clear and realistic considerations behind it.

(Figure 2 and Figure 3 are the contents of the “EagleTrader Trader Examination Rules Supplementary Terms” agreement)

Why set these restrictions?

1. Make sure the results come from “personal trading ability”

ET The core goal of the proprietary trading examination is not to select the “most beautiful curve”, but to determine whether this curve truly reflects a trader’s independent judgment ability.

If linked accounts, mutual copying or strategy copying are allowed, the trading results will be easily affected by the account structure or external decisions. In this case, even if the account is profitable, it cannot explain whether the trader himself has:

The ability to independently analyze the market

The ability to bear risks independently

The ability to continuously execute strategies in a single account

And these are precisely the most important foundations for entering the real fund management stage.

2. Guide more sustainable trading methods

The restrictions on ultra-short-term trading do not deny the short-term itself, but clearly distinguish two different sources of income:

One comes from market judgment and structural recognition

The other relies more on matching mechanisms, spreads or environmental differences

In a real capital environment, the latter is often difficult to replicate in the long term, and the risk increases significantly after the capital scale is enlarged.

Through the Trading Code of Conduct, ET

What I would like to see more is: a clear entry and exit logic; a trading method that can explain the reasons for risk exposure; and a trading method that can maintain consistency amid fluctuations. This is also the reason why many traders gradually slow down their trading pace and reduce invalid operations during the examination process.

3. Prevent “the trading rules themselves” from being used as an arbitrage object

In any assessment system, once the rules exist, it is inevitable that someone will try to “take advantage of the rules.” For example:

Reduce surface retracement through hedging or knockdown

Design complex structures to avoid statistical methods

Make the account appear stable, but lack the true direction exposure

The common feature of this type of operation is: they do not answer “Why do you want to take risks here?” ET’s restrictions on meaningless arbitrage and hedging are precisely to ensure that every transaction is still in the “trading market itself” rather than in the “trading rules”.

4. Establish behavioral habits required for professional trading in advance

From a longer-term perspective, these norms do not just serve exam results. They invisibly train traders to possess several keyAbility:

Discipline: execute under constraints rather than random trial and error

Consistency: use the same set of logic to deal with different market environments

Explainability: clearly know why you entered and why you left the market

For many traders, the real change is not “making the first money”, but the beginning to realize that stability often comes from choices within the rules, rather than attempts outside the rules.

The trading code of conduct established by EagleTrader is not to limit the creativity of traders, but to provide a clear test boundary for trading capabilities.

Under this framework, speculative shortcuts will be magnified and exposed; sustainable trading logic will gradually emerge. For those traders who want to become professional, adapting to these rules is an important screening and growth process in itself.